Market Insights & Analysis: Saudi Arabia Cards and Payments Market (2024-30)

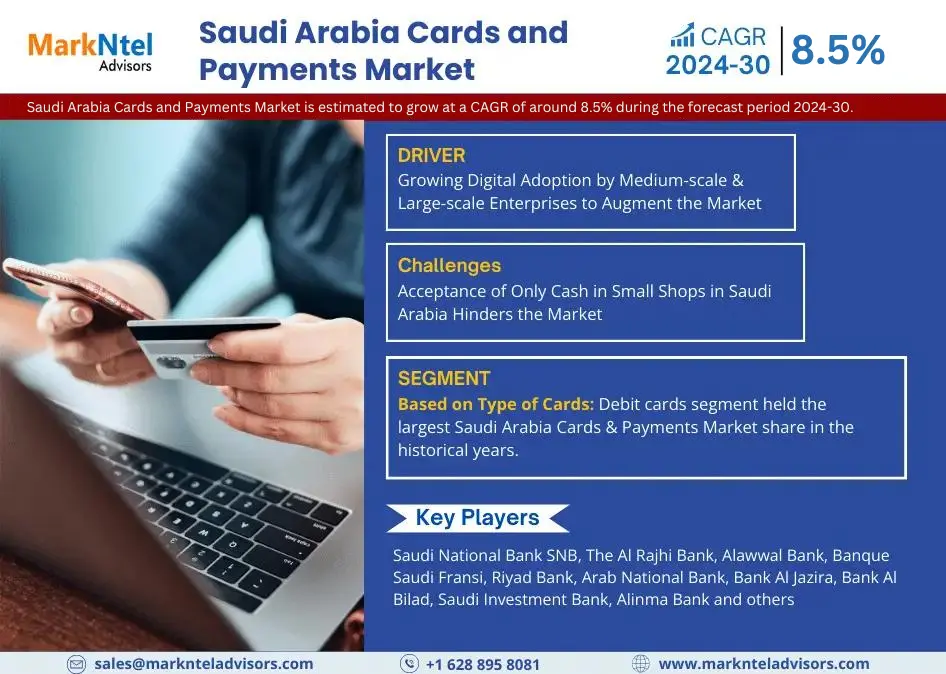

Projected Growth: The Saudi Arabia Cards and Payments Market is poised to expand at a compound annual growth rate (CAGR) of approximately 8.5% from 2024 to 2030.

Comprehensive Overview of the Saudi Arabia Cards and Payments Market

Utilizing both primary and secondary research methodologies, the Saudi Arabia Cards and Payments Market report offers an in-depth analysis valuable for stakeholders and investors seeking market insights. This report delves into market dynamics, providing a detailed examination of regional trends and developments.

Request an Exclusive Sample Copy of the Report Here: https://www.marknteladvisors.com/query/request-sample/saudi-arabia-cards-payments-market.html

Saudi Arabia Cards and Payments Market Opportunity: Rising Collaboration Between Financial Institutions & Tech-based Companies

The zero tax policies on the salaries withdrawn & lucrative job opportunities are propelling the young talent to mitigate to Saudi Arabia, as a result, the population of expatriates has been on the rise for the past few years. Hence, the aforesaid has resulted in a notable upsurge in foreign payments since individuals send some share of their salaries to their native hometown. These foreign transactions are possible via different cards offered by companies, such as Visa, Mastercard, etc. Hence, the companies have started collaborating with the National Bank of Saudi Arabia to provide different cash reward points & engage more consumers. For instance:

In 2022, the Saudi British Bank partnered with Visa to launch SABB Visa Platinum Credit Card, which offers unlimited cashback on foreign transactions at 2% & local purchases at 1%.

This increasing demand for rewarding credit cards in Saudi Arabia is driving partnerships between financial service providers and banking institutions. Hence, this trend aims to enhance the banking experience & meet the growing interest of end-users in reward programs, thereby boosting the market for banking cards in the country.

Saudi Arabia Cards and Payments Market Segmentation

By Type of Cards

-Debit Cards

-Fleet/Fuel Cards

-ATM Cards

-Prepaid Cards

-Credit Cards

- The Debit Cards segment held the largest share of the Saudi Arabia Cards and Payments Market in the historical years and is predicted to flourish during 2024-30

By Type of Payment Instrument

-Cards

-Mobile Wallets

-Credit Transfers

-Cash

-Debit Cards

-Checks

By Type of Payments

-B2B

-B2C

-C2C

-C2B

–E-Commerce Payments

–Payments at POS Terminals

By Transaction Type

-Domestic

-Foreign

By Application

-Food & Groceries

-Health & Pharmacies

-Travel & Tourism

-Hospitality

-Others (Media & Entertainment, etc.)

By Institution Type

-Financial

-Non-Financial

Explore More on the Saudi Arabia Cards and Payments Market Report Here: https://www.marknteladvisors.com/research-library/saudi-arabia-cards-payments-market.html

Key Players in the Saudi Arabia Cards and Payments Market

The report features major players including:

Saudi National Bank SNB, The Al Rajhi Bank, Alawwal Bank, Banque Saudi Fransi, Riyad Bank, Arab National Bank, Bank Al Jazira, Bank Al Bilad, Saudi Investment Bank, Alinma Bank,

Regional Analysis

The report covers a comprehensive analysis of the Saudi Arabia Cards and Payments Market across various regions:

- Central

- East

- West

- South

The research highlights development opportunities and challenges in these regions, encompassing sales growth, product pricing and analysis, growth potential, and strategic recommendations for addressing market challenges.

Key Questions Answered in the Saudi Arabia Cards and Payments Market Report

- Who are the major players in the Saudi Arabia Cards and Payments Market?

- Which region presents the most potential for the Saudi Arabia Cards and Payments Market?

- Which application area of the Saudi Arabia Cards and Payments Market is anticipated to grow significantly in the coming years?

- What opportunities exist for new market entrants?

- What is the projected market size for the Saudi Arabia Cards and Payments Market by the end of the forecast period?

- What are the growth prospects for the Saudi Arabia Cards and Payments Market?

- What is the base year considered in this market report?

- Which region holds the largest market share in the Saudi Arabia Cards and Payments Market?

- What factors are expected to drive the growth of the Saudi Arabia Cards and Payments Market?

About MarkNtel Advisors:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Contact MarkNtel Advisors:

Phone No: +1 628 895 8081, +91 120 4278433

Email: sales@marknteladvisors.com

Corporate Office: Office No.109,

H-159, Sector 63, Noida, Uttar Pradesh – 201301, India