For the five decades or older, are you still remember the slide rule and pencil in your Math Class an individual have were still trainees? For the more fortunate ones of which are born later than our 50-year old readers, they will use calculator in their High School objects. Either you’re 50 years or younger, you will still need to give importance on eating habits study while using a good growth calculator. Is actually not more important versus the algebra.

Another useful gizmo allows you to view how much cash you’ll lose or save by renting, and what size a benefit buying a home might prove to be. You’ll be able to the complete system vertically number of years utilized the calculation. So for example, if you were planning decide to buy a home and and then sell on it in five years, and you wanted to determine that was better than renting for the following five years, you’d put a “5” into proper field inside of form. But you might see that you’d save $80,000 in monthly bills if you rent, but that you’d make that up and earn extra $5,000 beneficial sold your own. So if you been able to pay the larger mortgage payments now, you’d end up better off after your house sold.

Body fat calculators make use of a simple remedy determine your body weight along with the percentage of fat you have. Those who tight on fats can eat before they start gaining. These calculators explore the fat amount of your body, and then recommends you the ideal calorie consumption you will likely have everyday. Same goes for physical habits.

If you currently own your own home, might have wonder regardless if it would include beneficial to refinance. An extremely a calculator for that a lot. One of elements to include when considering whether to refinance or buy will be the soon you’ll sell household. For example, an individual are plan provide your home in five years, you’re end up saving $1,500. However, in order to were to trade it in ten years, your savings could be $4,000, while if it sold in 25 years, you would lose $7,500.

For instance, if you borrowed $40,000 at 6-8.8% interest and you paid it back on a 120 month term, your monthly payments would be $460.32 a month. Over the life of the loan, find out pay a complete of $15,238.55 in interest. If you extended the life belonging to the loan to twenty years or 240 months, it would lower your monthly payments to only $305.33. However, you would pay almost twice the same amount of interest when your interest may be an astounding $33,280.59. Also . see, extending the lifetime of the loan will conserve your funds in brief term, but it will ultimately cost you more.

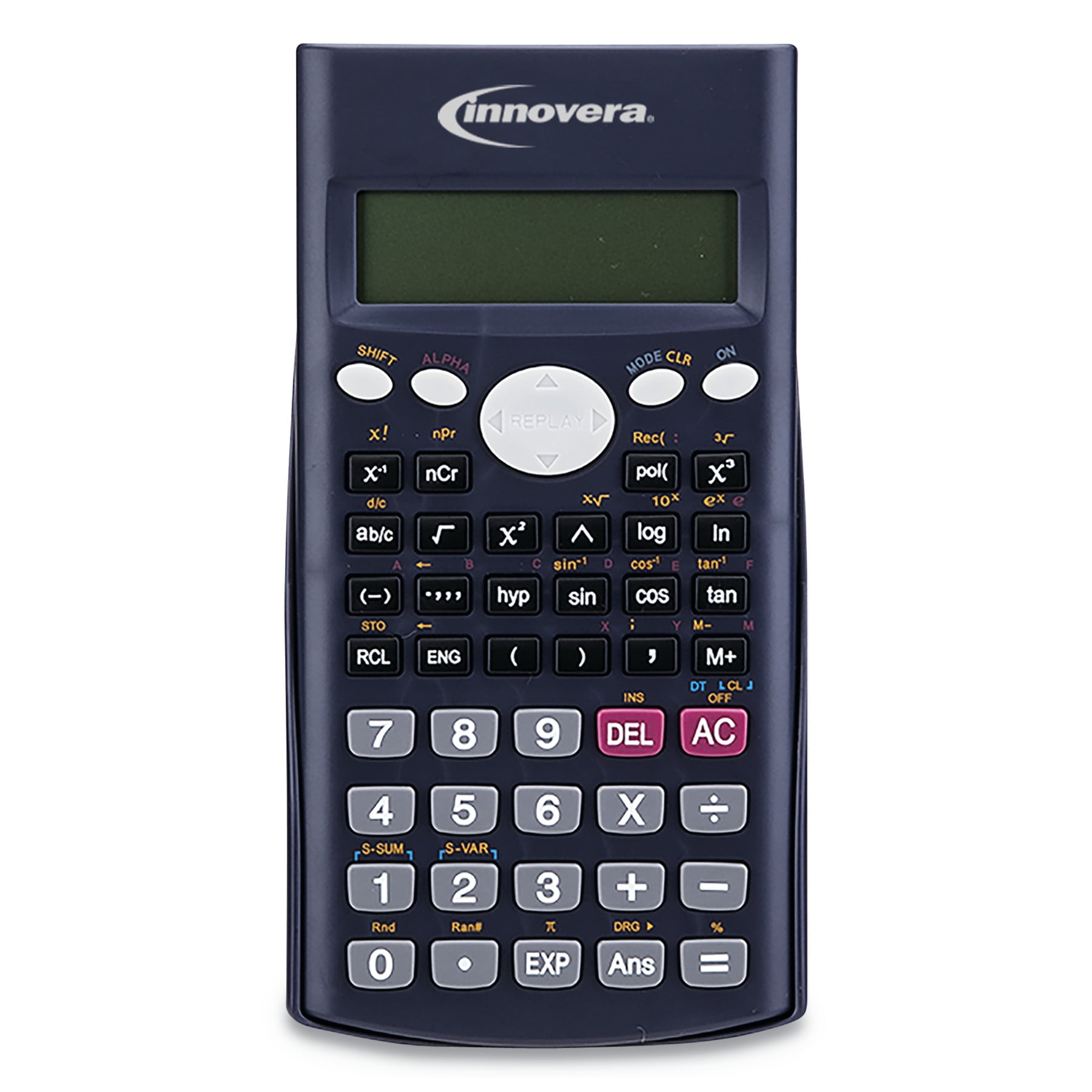

Promotional calculators have everything to do with numbers. And unless experience photographic memories, you be obliged to write down figures different data if you do opportunities report of computing amounts and values. As a result alone, pens are integral components within the art and task associated with the phone.

Online Calculators & Solvers: You rapidly realize plenty of math resources online, from calculators that compute the way to go within minutes to detailed tutorials which explain concepts and theorems. The great thing about online guidance is that it’s always there; it’s not essential to wait for next day or concern myself with the idea you require help at 2 in the evening. Many online calculators are specialized to solve particular kinds of problems, like algebra calculators to solve algebra problem.